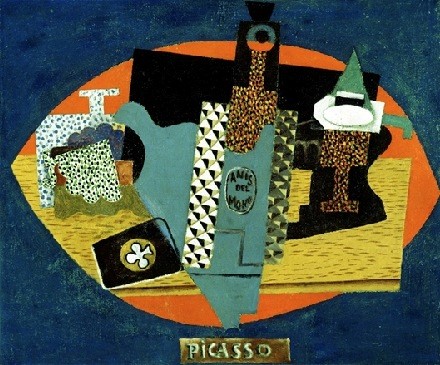

Pablo Picasso (Picasso) was world famous painter, sculptor, printmaker, ceramicist, stage designer, poet, and playwright. His works are famous for many things but you may be more prone to think of his abstract art when you hear of his name. Some of Pablo’s paintings have been sold for more than $100 million dollars. Pablo produced an estimated 13,500 paintings alone and when coupled with his other creations the total number of his artistic contributions would be over 145,000. Picasso (Picasso) died on April 8th 1973 while entertaining guests at the age of 91.

Pablo is revered for his ability to see the world differently and translate that perception to the canvas, but his abstract views should not have been allowed in estate planning. His estate boasted a large fortune of artwork, homes, gold, investments and other assets estimated to be between $100 and $260 million dollars. Although Picasso lived a long and productive life, he never got around to doing any sort of estate planning.

Legal battles ensued when it came time to settle his estate. The estimated cost to the estate because of the litigation among the heirs was $30 million. The feuding did not stop at the distribution, but even over 25 years after Pablo’s death there were still legal battles to determine the rights to sell Pablo Picasso’s name for merchandizing rights.

.

Pablo had children with three different women. If that wasn’t a warning sign enough for the need of estate planning, certainly his vast fortune was reason enough. Maybe he though artists shouldn’t have to be worried about the mundane and technical aspects of life, a $30 million transition fee together with all the fighting among his heirs can serve as a warning of what not to do.

Estate Planning does not have to be complicated or even efficient (how avoid the most taxes) if you are more worried about adverse effects (fighting heirs, enabling a life of self-indulgency) of inheriting wealth. Estate Planning does need to be done though, or you might well see 1/3 of the value of your estate eaten up in the transition.